Understanding International Insurance Billing in Panama

If you’re planning to move to or visit Panama, it’s essential to understand how the healthcare system handles insurance billing.

First, it’s important to note that if you have “Panama” health insurance, it is widely accepted at private hospitals throughout Panama, providing a seamless experience for residents and expats alike. However, getting Panama insurance may be challenging if you have pre-existing conditions.

See these Panama health insurance options. We have recommendations for Panamanian insurance brokers for Panama insurance in the Online Panama Relocation Guide.

The process can be quite different for those with international health insurance or traveler’s insurance. Here’s a comprehensive look at how insurance works in Panama and recent developments that are making it easier for expats and traveler

Prepay and Reimbursement Model

In Panama, most hospitals will not accept your insurance even if you have international health insurance or traveler’s insurance. This means you must pay for your medical treatment upfront, and then you file a claim with your insurance provider to get reimbursed. This process can be time-consuming and requires you to have sufficient funds available (or credit card limits) to cover the cost of medical services, especially for more extensive treatments or emergencies.

The ‘dirty little secret’ is that hospitals in Panama will NOT treat you until you either prepay or they get a guarantee of payment (GOP) from the billing company or insurance company, EVEN IF you have insurance that covers you worldwide.

The billing company can issue a Guarantee of Payment (GOP) 24/7 within 5 minutes of verifying your benefits.

Unfortunately, the hospital may not be able to reach the insurance company promptly, so you will need to prepay to get immediate medical care. The hospital will not work with some insurance companies with a reputation for slow pay.

I first discovered this problem when I got Covid in 2020. Even though I had international health insurance that covered medical emergencies in Panama, the hospital would not accept the insurance, so I had to pay $15,000 before they would even admit me to the hospital. Then, I had to file a claim to get reimbursed. It took nine months, and I was only refunded 50% of my bill.

The hospital would not even call the international insurance company to request a Guarantee of Payment.

Earlier this year, two clients had heart attacks. They both had Medicare Advantage insurance covering them for emergencies internationally. However, they had to pay $14,000 and $40,000, respectively, then file their claim to try to get reimbursed. They are still waiting!

I had to find a solution!

Since my COVID experience four years ago, I have been looking for a solution to bring an experienced billing company to Panama to handle international insurance billing since the hospitals would not do it. Finally, it’s happening in Panama!

Recent Improvements with Hospital Chiriqui

There’s good news! A billing company has recently partnered with Hospital Chiriqui in David, one of the country’s leading hospitals, to streamline the insurance billing process. This partnership allows certain insurance providers to offer verification of benefits and then a guarantee of payment to the hospital, meaning the hospital can directly accept these insurances without the need for you to prepay!

After your treatment, once the billing company receives the bills from the hospitals and doctors, it translates them into English, adds coding in the proper format, and then submits the claim to the insurance company. It then follows up with the insurance company to pay the hospitals quickly.

There is no fee for you to use this service. The hospital pays the billing company.

This significant change is a game-changer for many expats and visitors, eliminating the need to prepay and navigate the reimbursement process.

Insurance Providers Accepted at Hospital Chiriqui

The billing company working with Hospital Chiriqui currently supports the following insurance providers:

- United Health Care

- Blue Cross Blue Shield (BCBS), both Commercial and Federal Plans

- Kaiser Permanente

- Cigna

- Tricare and ChampVA (accepted at several Panama hospitals)

- Aetna

- Government Employees Health Association (GeHa)

This list covers some of the most popular insurance providers, making it much more convenient for anyone seeking medical care in Panama.

Some of these insurance companies only cover urgent care and emergencies, but some also cover outpatient care. Read your insurance policy or talk to your insurance agent for details about what is and is not covered in Panama.

Some insurance has a co-pay. Some do not. When you get a verification of benefits, you will know exactly what to expect.

You may want to contact the hospital’s international insurance department to verify that you do not have to prepay or to find out if you need pre-authorization for any medical treatments. The hospital or your insurance agent can usually print out a verification of your benefits.

In Panama, it’s not as easy as just showing your insurance card to get medical care!

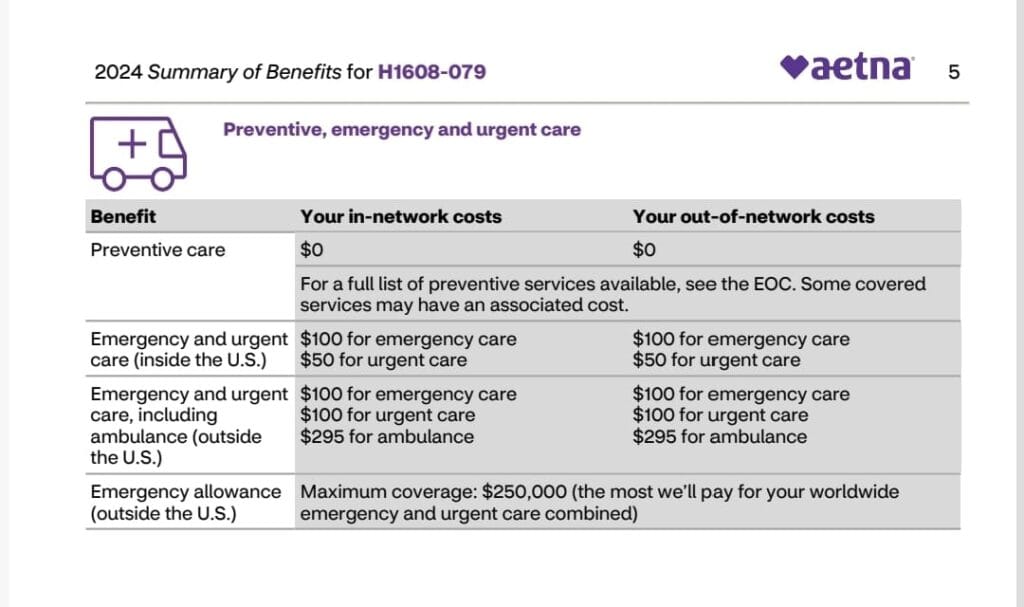

This is a sample verification of benefits:

What About Medicare or Medicare Advantage Plans?

Medicare does not cover you overseas. See this brochure with Medicare rules.

You can convert to a Medicare Advantage plan if you have Medicare Part A and B. There is no fee to convert, and it costs the same as Part B in most cases (about $170 a month). You can get a Medicare Advantage policy even with pre-existing medical conditions.

Medicare and Medicare Advantage are only for US citizens. It can ONLY be used for urgent care and emergency medical care in Panama.

If you have a Medicare Advantage plan, it will be accepted at some hospitals in Panama if it’s one of the approved insurances listed above. You have two options in this case:

- Switch to an approved insurance plan that the hospital can accept directly.

- Continue with the prepayment method and file a claim with your insurance provider for reimbursement after treatment.

Except for Tricare, the only two hospitals accepting these insurances are Hospital Chiriqui in David and Hospital Santa Fe in Panama City. Tricare is accepted at many hospitals in Panama with direct billing.

Expansion to Hospitals in Panama City

The billing company’s collaboration with hospitals is not limited to Chiriqui. Soon, several hospitals in Panama City will also be working with the billing company, allowing them to accept these international insurances directly. This expansion will further simplify the process for those living in or visiting the capital city.

Beware of Misleading Insurance Agents

It’s essential to be cautious when purchasing international health insurance, travel insurance, Medicare Advantage, or other insurance, as some insurance agents may claim that your policy will be accepted at hospitals in Panama when, in reality, this may not be the case.

If your insurance is not on the approved list, you will be required to prepay the entire medical bill and then file your own claim for reimbursement. This process can be both stressful and costly, especially in emergencies.

Be particularly wary of expats who present themselves as insurance agents in Panama. They may not always be fully informed or transparent about how insurance works in Panama and often make false and misleading comments on social media. I’ve noticed that the louder these expat agents are on social media, the less likely they are to know what they are doing. Some are downright rude!

Most of these expat insurance agents do not have a work permit to work in Panama legally. Ask to see their work permit. Foreigners living in Panama must have a work permit to sell any products or services to people in Panama.

Before you sign up for insurance, always verify directly with the nearest hospital to ensure your insurance will be accepted without prepayment.

Real Sad Examples:

For example, a Panama expat insurance agent put someone into an insurance policy that only covered them for the first 60 days out of the United States. They had been in Panama for six months when the husband had a stroke. They were stuck with paying the entire hospital bill and then filing a claim to get reimbursed. But their claim was denied because they were outside of the US for more than 60 days!

Another person went to the emergency room only to discover that their insurance was not accepted. Hospital Chiriqui wanted $5000 upfront before the person could be admitted for emergency surgery. Depending on what the surgeon found, there would be additional fees after surgery.

It’s so sad that the Panama expat agent sold them a worthless policy that is not accepted at the hospitals in Panama.

Experienced Agents!

We work with these three experienced insurance agents who can help you get the right insurance accepted in Panama.

Jerry Hauser

Whatsapp +1-612-386-7799

Email – [email protected]

Jeff Goble

Medicare Insurance Product Expert

website – Worldwideemergencycoverage.com

Cell/Text/Whatsapp/Signal: (916) 601-7128

[email protected]

Book a video or phone call: https://worldwideemergencycoverage.com/schedule-a-call

Wes Chapman

Website – https://www.fortendehealth.com

Email: [email protected]

Phone: +1-603-252-7340

I get no kickbacks or commission if you use one of these insurance agents. You can ask them.

I recommend them because they have many years of experience working the expats, and I know they will thoroughly evaluate your insurance needs before making recommendations. They are not rude, like some of the Panama expat agents. They will only recommend insurance that Panama hospitals accept without the need to prepay.

Key Takeaways

- Most hospitals in Panama require upfront payment, even if you have international or traveler’s insurance, and you must file your own claim for reimbursement.

- Hospital Chiriqui now works with a billing company that allows them to accept certain insurance plans directly, eliminating the need for prepayment.

- Accepted insurances include United Health Care, BCBS (Commercial and Federal), Kaiser Permanente, Cigna, Tricare and ChampVA, Aetna, and GeHa.

- Some Medicare Advantage plans are not accepted in Panama, even though they cover urgent care and emergencies. You must switch to an approved insurance plan or use the prepayment and claim method.

- Medicare does not cover overseas medical care.

- Soon, hospitals in Panama City will also work with the billing company, making it easier to use international insurance.

- Beware of expat insurance agents in Panama who might put you under a policy not accepted by Panama hospitals, forcing you to prepay for medical care.

This evolving system is a welcome change for many expats and travelers in Panama, providing more convenience and peace of mind when accessing healthcare services.

Submit a Comment